Repayment of Unemployment Insurance Benefits for Furloughed Federal Employees Frequently Asked Questions (FAQs) - Unemployment Insurance

- If I return to my federal government job after furlough and receive retroactive pay, will I have to repay any unemployment insurance benefits that I received during the federal shutdown period?

Yes. If you receive retroactive pay from your federal government job for the period of the shutdown, the payment (your wages) will be considered back pay and you will be required to pay back any unemployment insurance benefits that you received. You will be sent a form requesting detailed information regarding the receipt of your back pay.

- Can I cancel my unemployment insurance claim now that I have returned back to work?

You may request to cancel your claim by calling a claims agent at 667-207-6520. An agent will review your request. For claims agent hours, see the Claimant Contact Information webpage. Please note that hours may be modified during holidays.

- What should I do if another government shutdown occurs?

You can reopen your claim if there is another shutdown within the next 12 months. After 12 months or if you canceled your previous claim, you will need to establish a new claim.

- Will I receive official notification from the Maryland Division of Unemployment Insurance about repayment of these benefits?

Yes. Once the Maryland Division of Unemployment Insurance receives proof of your back pay wages, you will be sent a Notice of Benefit Overpayment indicating the overpayment amount due.

- How do I repay my overpayment balance?

You may pay your overpayment balance by:

- logging into your BEACON portal; and,

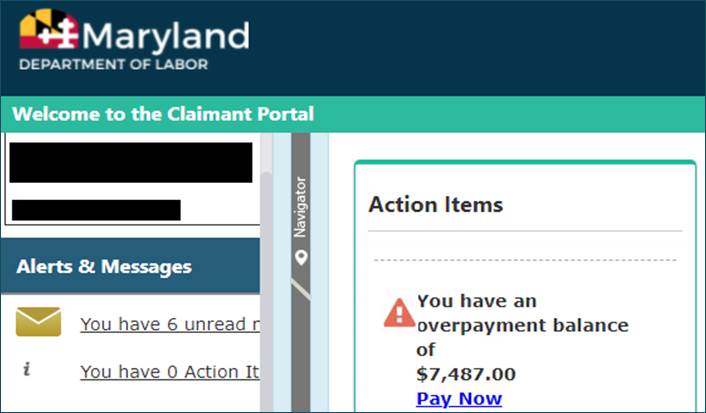

- selecting the “Pay Now” link under the Action Items section of your portal’s homepage. See the image below.

- In BEACON, you may pay by: credit/debit card (convenience fee of 2.5% of payment amount or minimum of $1.00); or from your bank account/electronic check.

You may also pay:

- by check or money order to:

- Maryland Department of Labor

P.O. Box 1931

Baltimore, MD 21203

- Maryland Department of Labor

- Will I be required to repay the entire overpayment balance all at once or can I establish a repayment agreement?

Payment in full is expected. However, if you are unable to pay the full amount at once, you can establish a repayment agreement to pay in installments.If you wish to establish a repayment agreement, log in to your BEACON portal and select “Benefit Payment” from your portal’s left menu. If you are eligible for a repayment plan, there will be a link titled “Payment Plan.”

For additional information, contact the Benefit Payment Control Unit at 410-767-2404.

- Can I request an overpayment waiver?

Yes. To do so, you must complete and submit an overpayment waiver application within 30 days (of the date listed on your original Notice of Benefit Overpayment). To download a waiver application and to receive additional information, please visit the Criteria for Overpayment Waiver webpage.

- If I am not approved for an overpayment waiver or do not abide by my repayment agreement, will my wages be garnished?

First, you will be given the opportunity to voluntarily repay the overpayment amount. If you fail to abide by the terms of your signed repayment agreement, you may be subject to other collection activities, including referral to the State of Maryland Central Collection Unit, the Maryland Tax Refund Intercept Program, and/or wage garnishment.

- Whom do I contact if I have further questions or special concerns regarding my overpayment of unemployment insurance benefits?

You may contact the Maryland Division of Unemployment Insurance Benefit Payment Control Unit by email or telephone.E-mail: FED.overpayments@maryland.gov

Telephone: 410-767-2404

Monday through Friday, 8:00 a.m. – 4:00 p.m., excluding holidaysAddress: Maryland Division of Unemployment Insurance

1100 North Eutaw Street

Benefit Payment Control Unit, Room 206

Baltimore, Maryland 21201