Overpayments and Fraud Frequently Asked Questions (FAQs) - Unemployment Insurance

- What is an unemployment insurance overpayment?

- How do I repay the overpayment?

- What is a repayment agreement?

- Can I appeal an overpayment?

- What is an unemployment insurance overpayment waiver?

- What if I am overpaid unemployment insurance benefits in another state and filed a Maryland unemployment insurance claim?

- What is unemployment insurance fraud?

- What is a fraud overpayment? If an overpayment is due to fraud, what penalties will be imposed?

- I was determined to have committed fraud because I worked part-time and had unreported earnings which were less than my weekly benefit amount. Why do I have to repay the entire weekly amount and not just the partial amount?

- How do I report UI fraud?

- I received a 1099-G tax form, but I did not apply for UI benefits last year. What should I do?

- How can I learn more and protect myself against UI fraud?

- What other resources are available if I am not eligible/disqualified for unemployment insurance benefits?

Overpayments

1. What is an unemployment insurance overpayment?

An overpayment occurs when a claimant (an individual who files an initial claim for unemployment insurance (UI) benefits) receives a benefit payment to which the claimant is not entitled. If you are overpaid, you will receive an overpayment determination. This determination will be sent via your preferred communication method (which you selected when you filed an initial claim) and available in your BEACON portal.

The overpayment determination will include the reason that you are overpaid, the weeks in which you were overpaid, the sections of the law that apply to your overpayment, and the total amount of the overpayment.

Overpayments can occur due to a penalty resulting from: employment separation; changes in a claimant's availability for work; audit results; unreported/underreported wages; and appeal decisions reversing eligibility, among other reasons.

Unless your overpayment is waived or overturned on appeal, you will be required to repay the overpaid benefits and any additional fines, penalties, and interest. Otherwise, legal action will be taken to collect the debt.

NOTE: You do not need to repay these amounts while any timely appeal or waiver request is pending.

2. How do I repay the overpayment?

Claimants can repay their overpayment in the online BEACON UI system by ACH electronic bank account transfer.

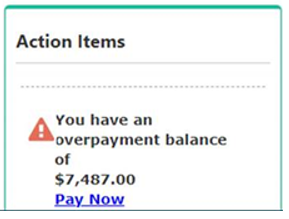

To pay, a claimant may log in to BEACON; navigate to the Action Items section of the portal home screen, select the “Pay Now” link under the overpayment balance; and follow the prompts.

3. What is a repayment agreement?

A repayment agreement allows you to pay the overpayment balance in monthly installments, if you are unable to pay the full amount of the overpayment. Information about the repayment agreement is included in the overpayment determination.

To establish a repayment agreement, log in to your BEACON portal and select Benefit Payment from your portal left menu. If you are eligible for a repayment plan, there will be a link titled “Payment Plan.” Each month you will receive a statement reflecting your monthly payments received prior to the 25th of the month, and your remaining balance.

4. Can I appeal an overpayment?

You may appeal an overpayment determination. Appeal instructions will be included in the determination.

- You can appeal the determination to the Lower Appeals Division in BEACON or in writing. If you disagree with the decision the Lower Appeals Division issues, you can file an appeal before the Board of Appeals. To learn more, see the Appeals webpage.

To file an appeal in BEACON:

- Log in to your BEACON portal. Select the "Correspondence" tab from the left menu, and then select the “Search” button.

- If there is a determination which is appealable, there will be a “File Appeal” hyperlink on the end of the row of that determination.

- Select the "File Appeal" hyperlink and fill out the form to file an appeal. At the end of that process, you will be issued an appeal number.

To file an appeal in writing, please include: (1) your name as it appears on the determination, (2) your Claimant ID number, (3) a telephone number where you can be reached, (4) the date of the determination that you are appealing, and (5) a brief statement of why you disagree with the determination that you are appealing. Send your appeal via:

- Mail: Maryland Department of Labor

Lower Appeals Division

2800 W. Patapsco Avenue

Baltimore, MD 21230 - Fax: (410) 225-9781

- Email: UILowerAppeals.Labor@maryland.gov

5. What is an overpayment waiver?

You can apply to have the Division waive your overpayment.

See the Overpayment Waiver Criteria webpage for qualifications and a waiver application.

6. What happens if I am overpaid unemployment insurance benefits in another state and filed a Maryland unemployment insurance claim?

Maryland is part of the Interstate Reciprocal Overpayment Recovery Arrangement (IRORA), which allows participating states to recover overpayments for each other. If you filed for unemployment insurance (UI) benefits in Maryland and another state requests that Maryland help recover your overpayment debt to them, Maryland will intercept your Maryland UI benefit payments and send those benefit amounts to that requesting state. You must address any questions, appeals, or other repayment arrangements regarding that state's debt with the other state.

UI Fraud

7. What is unemployment insurance fraud?

If you knowingly make false statements, misrepresent or fail to give important facts in order to obtain or increase unemployment insurance (UI) benefits, you may be determined to have committed UI fraud.

Some examples of UI fraud include:

- filing for benefits while working and not reporting your earnings; and,

- not reporting payments (severance, pension/annuity, vacation/holiday pay, back wages, etc.) when filing your initial claim or weekly claim certification.

For more information, see Unemployment Insurance in Maryland; A Guide to Reemployment.

NOTE: If you make an honest mistake on your initial claim or weekly claim certification, notify a claims agent at 667-207-6520 as soon as you discover the mistake to avoid penalties.

8. What is a fraud overpayment?

A fraud overpayment is the amount of unemployment insurance (UI) benefits paid for any week(s) in which it is determined that you were fraudulently filing for UI.

If you are found guilty of fraud, you will be:

- considered overpaid for all benefits acquired fraudulently;

- required to repay the fraudulently acquired benefits, with a 15% penalty and a 1.5% monthly interest payment;

- disqualified from receiving UI benefits for one calendar year; and,

In addition, you may also be subject to imprisonment, a fine of up to $1,000, or both.

9. I was determined to have committed fraud because I worked part-time and had unreported earnings which were less than my weekly benefit amount. Why do I have to repay the entire weekly amount and not just the partial amount?

If it is determined that you committed UI fraud, then you are penalized for the full week of UI benefit entitlement. For a non-fraud overpayment, you may repay a partial week of benefit entitlement.

10. How do I report UI fraud?

To report UI fraud to the Division, either:

- complete the Request for Investigation of Unemployment Insurance Fraud form and submit it by:

- Email - ui.fraud@maryland.gov or

- Mail - Benefit Payment Control, Room 206, 1100 North Eutaw Street, Baltimore, MD 21201; or,

- call 1-800-492-6804.

NOTE: The Request for Investigation of Unemployment Insurance Fraud form is also available in Spanish on the Division’s website.

11. I received a 1099-G tax form, but I did not apply for UI benefits last year. What should I do?

Tax form 1099-G is issued to any individual who received UI benefits for the prior calendar year. If you received a 1099-G but did not collect UI benefits last year, complete this affidavit form and email it, along with a copy of your picture ID, to dlui1099-labor@maryland.gov.

NOTE: Please retain a copy of the affidavit form.

For questions about an incorrect 1099-G, contact the Benefit Payment Control Unit at dlui1099-labor@maryland.gov or 410-767-2404.

12. How can I learn more and protect myself against UI fraud?

For more information about UI fraud, identity theft, and fraud prevention tips, see:

- Identity Theft Quick Protection Guide

- UI Fraud Awareness and Reporting Instructions

- Maryland Department of Labor and Maryland State Police Unemployment Insurance Fraud News Release

- Federal Trade Commission Tips for Victims of Unemployment Insurance Fraud

13. What other resources are available if I am not eligible/disqualified for unemployment insurance benefits?

- The Maryland Workforce Exchange (MWE) has several resources to help you find a job, including job listings, résumé assistance, virtual recruiter, labor market information, information about apprenticeships, training and educational programs, skills assessments, and many more.

You can access MWE online or in-person at a Maryland American Job Center.

- Visit one of Maryland’s American Job Centers, where trained counselors can assist you with your work search and training needs.

- For information about additional state services which may benefit you, see Maryland Social Services - Department of Human Resources Financial Assistance

Back to Top