Maryland's Unemployment Insurance Payment Plans - Unemployment Insurance

Employers may request to pay their quarterly contributions through a payment plan.

Payment plan options (available for all four quarterly unemployment insurance contributions) are listed below. Requests for payment plans should be made by the due dates (to file quarterly UI tax and wage reports and pay UI taxes): April 30, July 31, October 31, and January 31.

NOTE: If the due date falls on a Saturday or Sunday, reports/payments are due on the next business day.

Payment plan options include:

Plan #1:

- Quarterly tax return and wage report filed timely;

- 50% of tax paid when the quarterly return is filed;

- Remaining tax due is spread over three equal monthly installments, due on the last day of the next three months;

- Note that the last installment of this plan coincides with the due date of the next quarter, and unless another payment plan is in place, the reports must be filed and the tax must be paid by the due date.

Plan #2

- Any individual plan that was established with the Maryland Division of Unemployment Insurance (the Division), which mutually serves the interest of the Division and the employer.

You may request a payment plan via BEACON. To do so, log in to your BEACON portal, select Payments from the left menu, and then select Payment Plan.

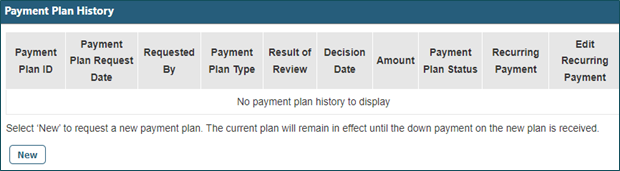

You may select the New icon at the bottom of the screen to request a new payment plan.

Employers who have questions may contact the Employer Call Center at 410-949-0033.